prince william county real estate tax assessment

You may view the 2022 assessments via the online Real Estate Property Assessment System. Prince William County VA currently has 464 tax liens available as of April 16.

The Assessments Office mailed the 2022 assessment notices beginning March 14 2022.

. Such As Deeds Liens Property Tax More. Search Valuable Data On A Property. You will need to create an account or login.

Enter jurisdiction code 1036. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of median property taxes. Reporting upgrades or improvements.

You can contact the Prince William County Assessor for. The tax rate is expressed in dollars per one hundred dollars of assessed value. Ad Find Out the Market Value of Any Property and Past Sale Prices.

2022 Tax Relief Brochure. For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. For additional eligibility criteria please contact the Real Estate Assessments Office at 703-792-6780.

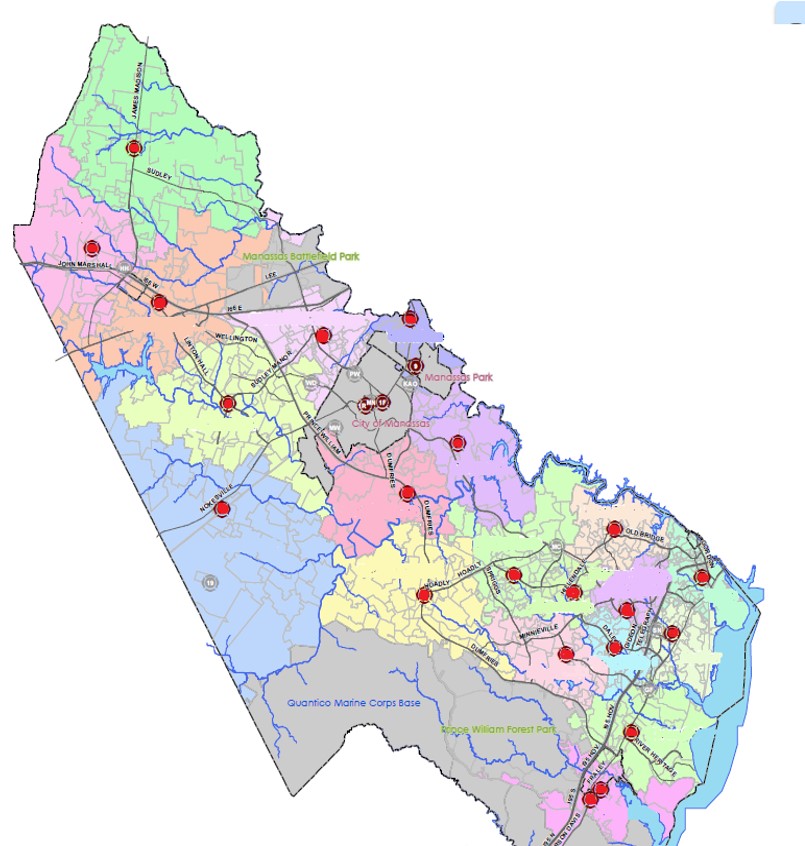

300000 100 x 12075 362250. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. The property tax calculation in Prince William County is generally based on market value.

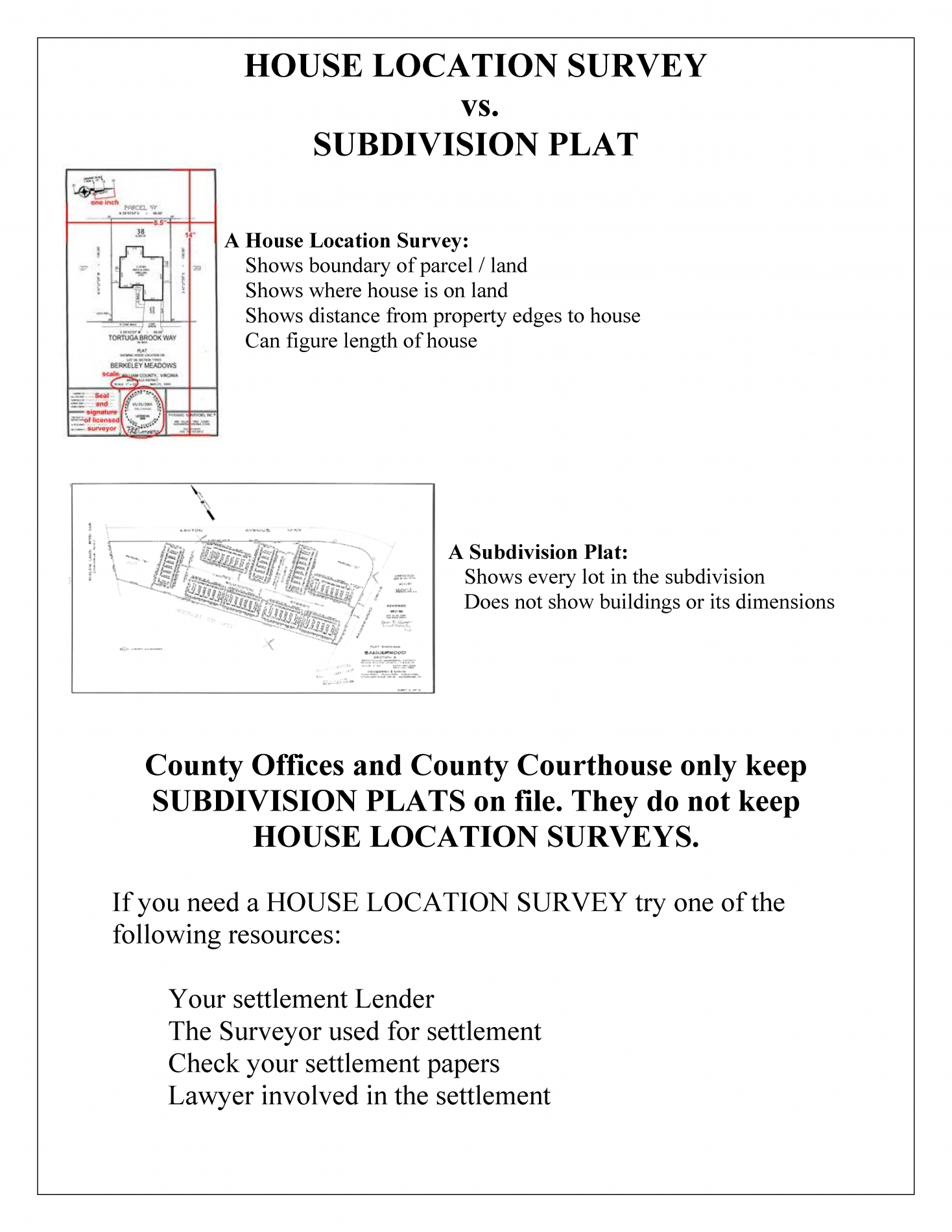

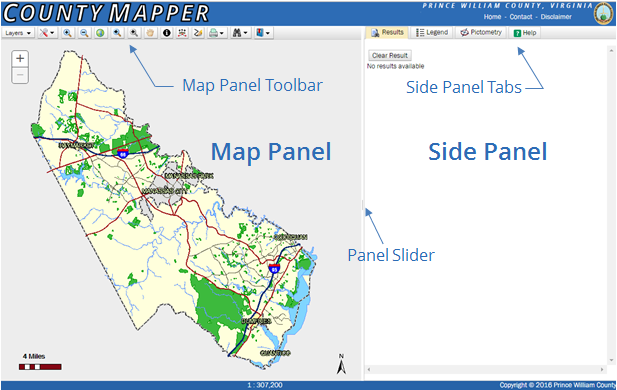

Use both House Number and House Number High fields when searching for range of house numbers Street Name. Enter your payment card information. Checking the Prince William County.

You can pay a bill without logging in using this screen. To make matters worse for residential property owners property tax bills are expected to go up in Prince William County. Report changes for individual accounts.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Prince William County VA at tax lien auctions or online distressed asset sales. Enter the house or property number. Press 2 to pay Real Estate Tax.

Click here to register for an account or here to login if you already have an account. Press 1 to pay Personal Property Tax. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Report a New Vehicle. Prince William County - Log in. Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure.

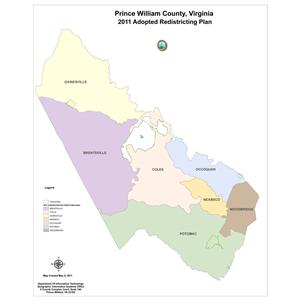

If you have questions about this site please email the Real Estate Assessments Office. Own and occupy the home as hisher sole dwelling. The desirability of your neighborhood.

Appealing your property tax appraisal. Start Your Homeowner Search Today. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return. The system will verbally provide you with a receipt number for you to write down. The average yearly property tax paid by Prince William County residents amounts to about 32 of their.

Enter the Account Number listed on the billing statement. The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia. The real estate tax is paid in two annual installments as shown on the tax calendar.

Enter street name without street direction NSEW or suffix StDrAvetc. Prince William County accepts advance payments from individuals and businesses. Information on your propertys tax assessment.

Report a Vehicle SoldMovedDisposed. By creating an account you will have access to balance and account information notifications etc. Prince William County Assessors Website Report Link.

Ad Get In-Depth Property Tax Data In Minutes. In an effort to mitigate the impact of rising residential real estate assessments the proposed budget is funded at a reduced real estate tax rate of. Dial 1-888-2PAY TAX 1-888-272-9829.

Report a Change of Address. -- Select Tax Type -- Bank Franchise Business License Business. Your homes square footage.

During the assessment of your property your local tax assessors are supposed to determine the market value of your property based on. The Prince William County assessors office can help you with many of your property tax related issues including. The Prince William County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Prince William County and may establish the amount of tax due on that property based on the fair market value appraisal.

These buyers bid for an interest rate on the taxes owed and the right. Prince William County - Home Page.

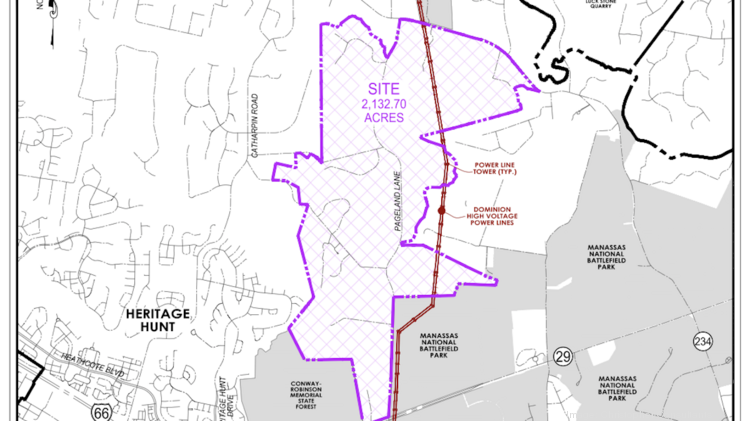

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

Prince William County Va News Wtop News

Acting County Executive Proposes The Fiscal Year 2023 Budget Prince William Living

Job Opportunities Prince William County

Fillable Online Liamsdad V I R G I N I A In The Circuit Court Of Prince William County Cheri Smith Plaintiff V Liamsdad Fax Email Print Pdffiller

Prince William County Sheriff S Office Wikiwand

County Proposed Average Tax Increase Of 250 In Fy2023 Budget Bristow Beat

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

Bland Family Of Stafford Prince William Loudoun Co S Va And Edgefield County Sc Goyen Family Tree

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Now Accepting Applications Restore Retail Grant Program

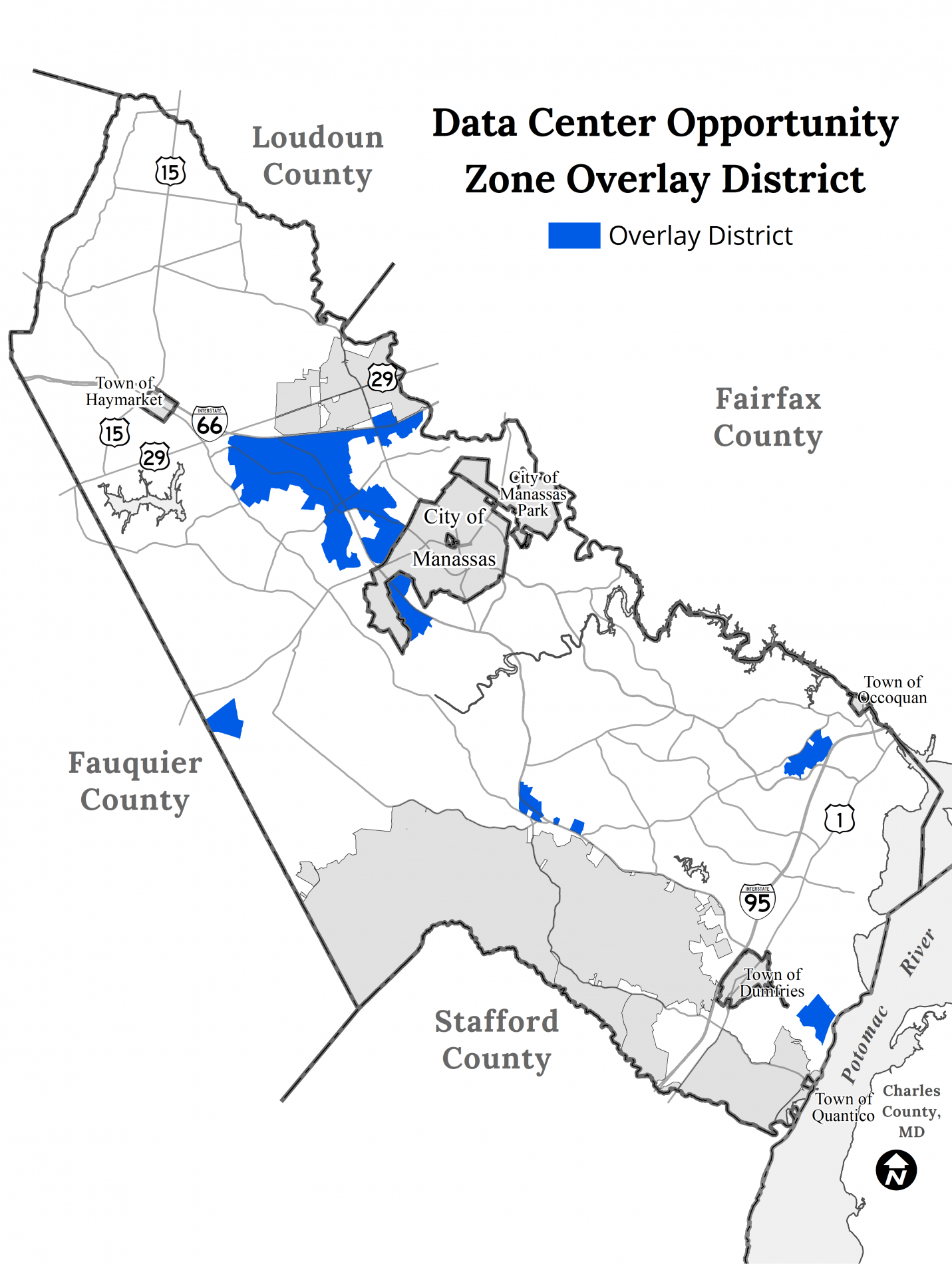

Data Center Opportunity Zone Overlay District Comprehensive Review